Global Sake Import and Export Market

—————————————————————

Japanese Sake export: 2023 update 2

The Japan Sake Brewers Association has announced that the total amount of sake exported in fiscal 2023 (January to December) was 41.08 billion yen (87% compared to last year), and the quantity was 29,000 liters (81% compared to last year). The number of export destination countries has reached a record high of 75 countries.

Until last year, export value had been at a record high for 13 consecutive years, but this year’s decline was largely due to the influence of China and the United States, which account for about half of export value and volume. The decrease in value is small compared to quantity, and sake with high added value continues to be exported. In China, the effects of a slump in high-end Japanese restaurants due to the economic slowdown and measures such as the temporary suspension of imports of Japanese marine products are likely to be felt, while in the United States, the effects of inventory adjustments for arrival in 2022, a decline in consumer sentiment due to staff shortages and inflation are likely to be affected.

China ranks first in export value, and America ranks first in export quantity. South Korea and Taiwan are positive. Until 2022, exports continued to increase except in 2020, when the impact of the new coronavirus disaster was felt, but the slowdown in 2023 is due to the ALPS treated water problem at TEPCO’s Fukushima Daiichi Nuclear Power Plant and the economic slowdown in China.

Although Japan’s sake exports to China in 2023 slowed down, it will maintain its No. 1 position by export destination, and China’s presence in the sake export market remains high.

By country, the number one export value was China with approximately 12.47 billion yen (88.0% compared to last year). Sake in China was popular among wealthy people as a high-class alcoholic beverage, and people used to enjoy bringing their favorite sake to restaurants. This was a negative result due to a decrease in demand. Hong Kong also decreased to approximately 6.02 billion yen (84.7% compared to last year). On the other hand, exports increased by 2.90 billion yen (115.1% compared to last year) from South Korea and 2.68 billion yen (120.5% compared to last year) from Taiwan, as well as by Italy, Brazil, and Spain, which exceeded last year’s results. Ta. In addition, in the United States, which ranks first in export volume, the result was 6,502 kg (71.6% compared to last year) due to inventory adjustments and inflation. Export volumes increased by 4,192 kl from South Korea (103.4% compared to last year) and 3,104 kl from Taiwan (100.9% compared to last year), and the export value for both countries remained steady.

There are many countries and regions where sake is still poorly recognized overseas, and sales channels are unevenly distributed through Japanese restaurants, so we believe that further market expansion is possible. In addition, it was announced that the number of foreign tourists visiting Japan in 2023 will recover to around 80% of the pre-coronavirus level, reaching around 25 million, thanks to the weaker yen, and that inbound consumption will reach a record high of 5 trillion yen. (Japan National Tourism Organization). Sales of the national sake campaign at major international airports (Narita, Haneda, Chubu, Kansai, New Chitose, and Fukuoka) conducted by the Chuokai are also going well, and we hope to increase inbound consumption, including local sake brewery tourism, in the future. We will promote exports through synergistic effects with expansion.

The export value per liter continues to trend upward. The “premium” sake trend continues.

Although both the export value and quantity were lower than the previous year this term, the export value of sake per liter continued to rise in 2023, as it did in 2022, reaching a record high. Especially in China, Hong Kong, and Singapore, the amount exceeds 2,000 yen/liter. Ten years ago (2013), the average export value was 650 yen/liter, but in 2023 it will more than double to 1,407 yen/liter. Relatively expensive sake is driving the world market.

Medium- to long-term prospects for future sake exports

In the United States, awareness of sake is high in New York and California, but low in Texas and Florida, and we believe that it will continue to grow regionally. On the other hand, China, the United States, and Hong Kong account for approximately 70% of our export value, so it is important to diversify our export destination countries and regions. In addition to Southeast Asia, we are also paying attention to Brazil and Mexico in Latin America, where the number of Japanese restaurants is rapidly increasing.

In the medium to long term, we expect that Asia and Oceania will benefit from the gradual elimination of tariffs under the Regional Comprehensive Economic Partnership (RCEP) agreement between Japan, China, South Korea, Australia, New Zealand, and the 10 ASEAN member countries. .

Additionally, organic labeling equivalence has been approved with Canada and Taiwan, making it possible to export JAS-certified organic sake. We believe that as mutual recognition with partner countries progresses, sake will spread to the overseas organic market.

Japanese Sake export: 2023 update

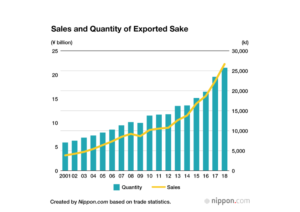

Exports of Japanese sake have grown in step with the global Japanese cuisine boom, setting a record high for the 13th consecutive year in 2022.

The continuing boom, with the value of Japanese sake export shipments surging 18.2 percent last year to 47.4 billion yen (about $340 million), is also being fueled by younger sake brewers targeting a more upscale market with premium products and taking steps to foster a sake culture overseas. Sakeportal has been strongly promoting new innovative sake brewed with traditional techinques, along with the new lower alcohol fruit sakes– which deserve a push.

In terms of volume sake export showed a 12% increase year on year achieving a record-high of 35,895 KL (Reference: Trade Statistics of Japan)

By country:

China ranked 1st in contributing the most in total export value. China continued to rank first in export value by country, with approximately 14.16 billion JPY (137.8% increase year-over-year). The growth in China can be attributed to the continuous growth in the popularity of sake among younger generations and the upper class as a ‘high-end’ alcoholic beverage.

Record-high growth in export value can be seen in the majority of countries such as the total value of export in South Korea growing to 2.52 billion JPY (167.9% increase year-over-year) ranking 4th as an example.

The USA continued to rank 1st in the total volume of Japanese sake export with 9,084 KL (102.9% increase year-over-year) and ranked 2nd in the total value of export with approximately 10.93 billion JPY.

Closely following the USA was Taiwan, and the the top 3 countries accounted for 67.8% of the global total.

Furthermore, the growth rate of export value significantly exceeded the growth rate of export volume. The average export price per liter has doubled when compared to 10 years prior with trends showing a continuous increase in the popularity of exports of premium sake of a higher price range.

Expected Future Potential Growth in Southeast Asia and Europe

In Southeast Asia, the Japanese sake market is expanding rapidly with export value increasing in countries such as Malaysia (187.5% year-over-year), Vietnam (236.6% year-over-year), and Thailand (201.7% year-over-year). With the continuous popularity of Japan with inbound visitors from Southeast Asia, the market is expected to grow even further in the future.

In Europe, the export value of sales continues to steadily grow to reach 25.51 billion JPY (125.3% year-over-year).

Through the promotion of Japanese sake at globally renowned liquor trade fairs and events in France and Germany, the aim is to further support the expansion and growth of the market.

Continuous Positive Trend of ‘Premium’ Sake Export

Stretching from 2021, the export price of sake per liter is continuously increasing. When compared to the average export price of 633.0 JPY 10 years ago (2021), the price has more than doubled to 1,323.1 JPY in 2022. Currently, the value of exports exceeds 10% of the value of domestic shipments.

This trend can be attributed to a variety of factors driven by the revitalization of the economy such as the reopening and the increasing number of Japanese restaurants globally (approximately 159,000 restaurants globally in 2021), the widespread use of refrigerated shipping management ensuring quality preservation, and the increase in recognition of sake outside of Japanese restaurants as a high-quality versatile drink.

Overall Recent Trends

The export market in the USA, China, Korea, and Southeast Asia is expanding after the economic recovery from the Covid 19 pandemic. In addition, Canada can be seen as growing both in export volume and value.

Vietnam, Malaysia, and Thailand showed remarkable growth rates in both volume and value. Southeast Asian countries such as Singapore, where high-priced sake is favored, are expected to be a market in which further market growth potential is projected.

Different sakes such as Aged sake, fruit sakes, sparkling sakes and bulk sake used for RTD drinks are expected to increase growth through 2024.

Japanese Sake export: Latest data from May 2022

Happier news all round!

Showing a 166.4% increase year-over-year; the total value of Japanese Sake exports reached 401.78 million JPY , while the total volume of exports reached 32,053 KL (Trade Statistics of Japan) in 2021.

This record-high growth for the 12th consecutive year is hopefully linked with the global reopening of many suffering bars and restaurants.

Continuing the trend seen for a while, China provided the highest total value of export, followed by the USA and Hong Kong in 3rd.

The USA provided the highest total volume of export, followed by China and Hong Kong in 3rd.

Of special notice was that France held the highest percentage of growth in both total value and volume in 2021. We hope this French growth will inspire and spread across Europe and the UK in the coming years.

2021 Update & Coronavirus Impact on Sake exports and imports

In May 2021, total export volume increased to 3.2 million litre.

Over the last few months, low to mid-range Sake exports showed better growth compared to premium Sake : this is to be expected given the Coronavirus impact on customers budgets and profits.

Sakeportal expects the demand trend, before Coronavirus, for more premium Sake will resume in the near future.

Overall, the Sake export and import market is showing a revival and starting to grow post Coronavirus.

Looking at volume by area from January 2021 to May 2021 there has been steady growth in Asia, Europe and America; with East Asia showing the largest growth percentage. Western Europe has impressively bounced back and imported 8 times more Sake than last year. It shows how harsh the situation was and hope continues that Sake imports will continue to increase.

2020 Coronavirus Impact on Sake exports

The full impact has not been reflected yet but the total Sake shipments January to March 2020 was down about 18.4% on the previous year.

Global impact on importers has (of course) been massive with some importers in the USA losing 80% of their sales (JETRO). The full impact and data will be available middle of 2021.

Near future growth

With Japanese Sake makers making new innovative flavors, the upcoming Olympics (maybe) and the 156,000 restaurants serving Japanese food outside Japan in 2019, (compared to just 24,000 in 2006), when normal business resumes it is hoped there will be a renewed drive and interest in Sake.

Sakeportal foresees one of the biggest growth opportunities in the Sake RTD market.

2019 Update

Sake exports reached a record high for the tenth consecutive year on a value basis in 2019, at about 23.4 billion yen, representing 2.48 million 8.64L cases.

Although exports only account for 4.6% of the entire sales of Sake, this ratio is expected to grow as domestic sales are still shrinking.

The global market is anticipated to register a CAGR between 4.7%- 12.5% (depending on the forecast company).

The North American market remains the largest importer of Sake followed by Europe and Asia Pacific.

Within Europe, France is the stand out with imports of Japanese Sake currently at record levels: sales reached $2.6 million in 2019- more than four times the figure 10 years previously.

However the type of Sake is imported is not similar:

Within the more Sake sophisticated Asia Pacific market there is a relatively bigger demand for higher priced Sake and smaller brewery Sake compared to the North American market.

The Sake market is still globally dominated by the well-known mass-manufactured brands but as consumers are becoming globally more Sake sophisticated they are expected to follow the Asia Pacific market and seek out smaller artisan brands: in trend with overall alcohol beverage market. Similarly, at present, around 70%–80% of the Sake produced is non-premium or low priced Futsushu; growth is expected to occur relatively more in the premium range (Ginjo and Daiginjo): again, in line with the overall alcohol beverage market.

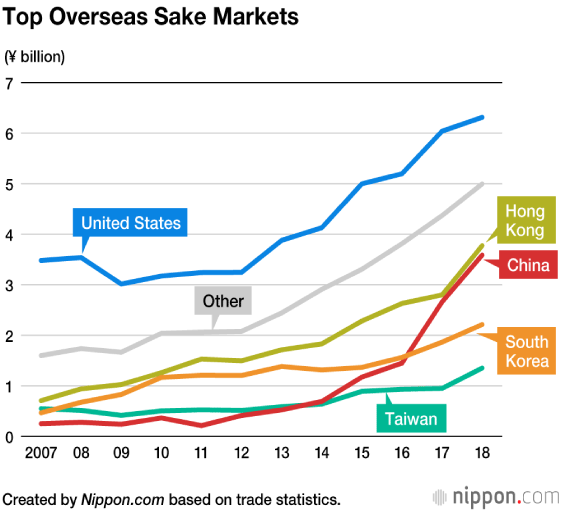

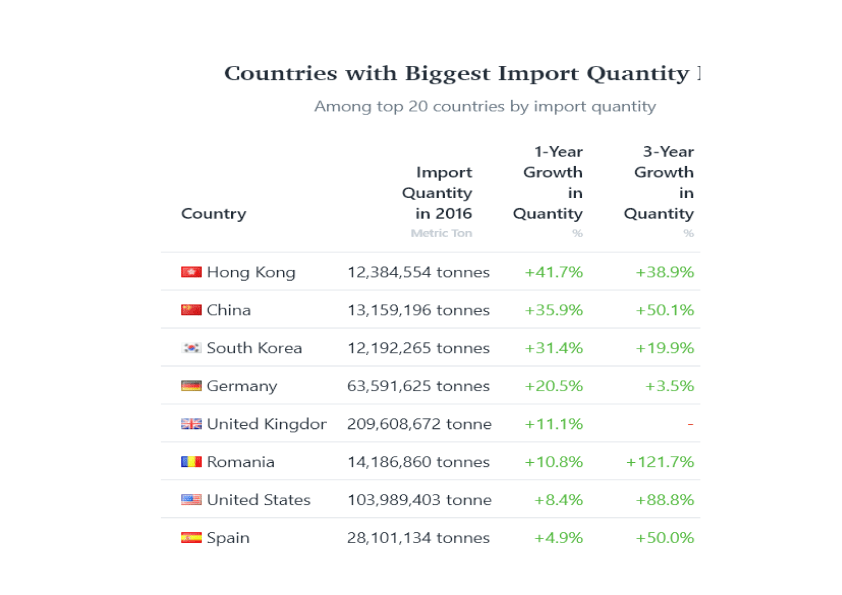

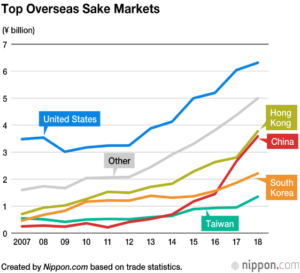

The Global Sake Import and Export market

Sake, also called nihonshu, is rapidly going global and the number of Sake drinkers is rising sharply around the world. The Global Sake export market is showing great growth: the value of Japan’s annual Sake exports doubled over the past five years to a record-high 22.2 billion yen ($200 million) in 2018 with Japan’s tax agency data indicating a 21% rise in the global Sake exports year on year. The USA is the top export market with total Sake imports worth $45 million in 2016 following America are the Asian countries of Hong Kong, China, Korea, Taiwan, Singapore and the European countries headed by the UK and France. Recent Trade Agreements with the EU and the CPTTP Agreement covering most of Asia and Canada will also have an added positive impact on sales of imported Sake.

The fastest-growing Sake import market is China and exports sharply rose by more than threefold from 2008, additionally they more than doubled to South Korea. In many other countries Japanese food has already become popular and is now regarded as a normal choice for diners, combined with the rise in Japanese culture, the upcoming Olympics and the huge surge in tourism to Japan; Sake is now a regular product on restaurant menus, in hotels and in supermarkets. The growth in the hospitality sector was being particularly led by the higher-end establishments but has now filtered down to the more mainstream. Also we are seeing Sake bars popping up across the world.

The result is that businesses are now requesting Sake distributors to supply higher-end, rarer Sake. Sakeportal has noticed that as Sake becomes more mainstream, the demand for Sake has changed as the market and the consumers are becoming more sophisticated. With people becoming more aware of Japanese Sake (and Japan in general) they are seeking out new, interesting Sake to import that is in tune with global trends. This is reflected in orders from our clients for non-mass produced Sake with brand stories allowing them to offer attract new consumers and have a differentiated sales points over their competition. With Sakeportal’s private label service businesses can go that extra step and have their own branded Sake for a truly unique sales point.

This is not only great news for Sake export companies but also the Sake trend has created new business ideas across industries from shipping companies now offering bespoke services for the safe shipping of Sake to overseas Sake Sommelier courses. For Sake suppliers and sellers they are grasping this opportunity and developing Sake in ways to match and attract their domestic market. Recent trends include new innovative food pairings, Sake tasting events and Sake cocktails are becoming very fashionable in many major cities. Good Sake distributors will keep up to date with the latest regional and global trends and should adapt their business models to match these trends. At present, the remaining global trend of Artisan is still on point. The inherent sales point that most Sake is not mass-produced and brewed from local brewers matches this global Artisan trend.

Although there is still some market education to be done, thanks to the above factors it is now of minimal concern for Sake distributors and importers. Sake is an exciting new product for many and the Sake export trend is set to continue over the next 5 or 6 years.

Previous Article

Previous Article Next Article

Next Article

- Categories:

- Share :

Previous Article

Previous Article Next Article

Next Article